Immediate impacts of the Leasehold and Freehold Reform Bill

All five options proposed in the Government’s consultation on capping ground rents could cause freeholders to go insolvent. Find out more about the immediate and subsequent impacts of a ground rent cap being included in the Leasehold and Freehold Reform Bill.

Once the Bill receives Royal Assent

- The likelihood of freeholder insolvency will increase once the Bill has passed, meaning that leaseholders’ insurance policies are likely to become legally ‘frustrated’ and be cancelled in line with policy terms and conditions.

- Additionally, Managing Agents will no longer have a mandate to collect, hold, or spend service charge funds. Where service charges are held by the freeholder and said freeholder becomes insolvent, it will be very difficult for leaseholders to gain access to their funds.

- Amidst the uncertainty, a lack of access to legal information on specific properties and no access to mortgages will cause flat sales to collapse.

3 months after Bill is passed: Assumed widespread freeholder insolvency

- With no freeholder present and no mortgages available for flats in uninsured buildings, flats will become unsellable. Items such as deeds of covenant, deeds of variation, deeds of rectification, deeds of compliance will not be capable of being actioned at the point of sale.

- Prices will fall dramatically as a result, with the possible risk of negative equity for those leaseholders stuck in affected flats.

- With contractors refusing to work for insolvent landlords, key services such as cleaning, lift maintenance, reactive repairs and security will cease. Freeholders will stop loan pre-funding of major works where there is insufficient reserve fund leading to delays in major remediation.

1 year after Bill is passed: Residential buildings stuck in limbo

- In the event insurers have not renewed or cancelled mid-term, there will be no party to instruct renewal, leaving buildings uninsured and leaseholders in breach of their mortgage.

- Hundreds of thousands of ‘zombie’ buildings will flood the insurance market. Increased administration demands will lead to a further increase in premiums for leaseholders.

- Buildings will become more evidently unmanaged and unmaintained, facing an increased state of disrepair.

- With building safety projects in limbo, leaseholders will be liable to fund remediation and face personal bankruptcy.

Leasehold and Freehold Reform Bill will hurt the public

Find out more about how the Leasehold and Freehold Reform Bill will hurt the public by clicking below.

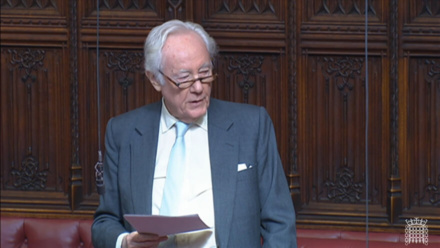

Members of the House of Lords shared their thoughts on the Bill’s impact in a Parliamentary debate

Lord Moylan

Lord Sentamu