Mortgage providers must be honest – ground rents are not an excuse for failing to lend

In January 2023, Director of the RFA Mick Platt highlighted that by blaming leases and the ground rents, lenders are misinforming sellers, holding up transactions and raising unnecessary bills for lease variations.

For some months now mortgage lenders have been tightening their lending criteria. The cost of living crisis and the rise in interest rates have caused lenders to withdraw products and offers, mindful no doubt of the bail-out they needed in 2008.

However, there is now clear evidence that lenders are using ground rent levels as an excuse for not lending on leasehold flats. Freeholders are receiving more and more requests for variations to lease clauses to render them acceptable to lenders and are being blamed for property transactions falling through if the lease does not meet lender requirements.

The perception being created by lenders amongst the leasehold flat-owning community is completely false. Ground rent is one small outgoing, along with food, household bills and other expenses which are assessed by lenders when considering whether or not to advance funds. The average ground rent is £200 per annum and not exposed to global macro financial and geo-political issues; by comparison energy prices are £2,500 and predicted to jump further, and the cost of living is rising at a rate not seen in a generation.

| Outgoings | Monthly | Annual | % |

| Mortgage | £ 1,000.00 | £ 12,000.00 | 62% |

| Council | £ 100.00 | £ 1,200.00 | 6% |

| Utilities | £ 250.00 | £ 3,000.00 | 15% |

| Service charge | £ 250.00 | £ 3,000.00 | 15% |

| Ground rent | £ 16.67 | £ 200.00 | 1% |

| Total | £ 1,616.67 | £ 19,400.00 | 100% |

It is inconceivable that the one item which can be identified for the entire mortgage term should be the sole reason a loan application is refused – especially as evidence suggests that ground rents as a proportion both of house prices and earnings are at an all-time low.

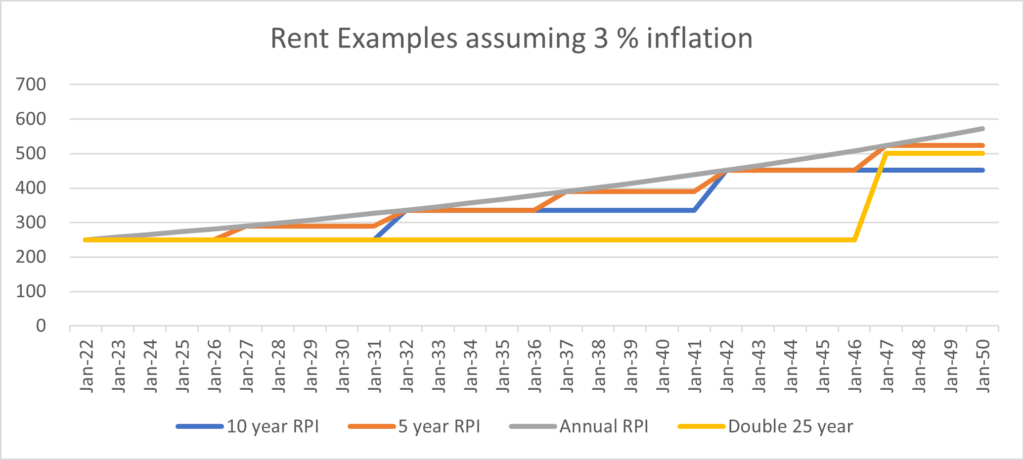

Additionally, some of the requests for lease variations being received are non-sensical. We are aware of two lenders who have requested a ground rent which doubles every 25 years be amended to an inflation-linked review despite the fact that inflation levels currently imply a doubling every 8 years. One would expect better from a financial institution and yet this is the line which is being peddled to sellers; your purchaser cannot get a mortgage unless the lease is amended. Lenders are also making the incorrect assumption that amending the lease is straightforward; any amendment will inevitably involve a loss of future income to freeholders and the pension funds which back them and therefore a premium will need to be paid by way of compensation, adding further complication to the already-stressful sale and purchase process.

Clearly lenders have changed their criteria – after all they were happy to provide mortgages on the same leases four years ago. And it is impossible to blame lenders alone as they will often rely on valuation “experts” who are asked to opine on the ground rent terms. During a recent seminar on ground valuation, a residential valuation expert on a panel was heard commenting on how an RPI linked rent review over 5 years was onerous in comparison to a 10 year review pattern. Such economic incompetence leads lenders down a dangerous path and the RICS needs to be on top of its members in how they assess value in residential leases.

However, lenders and their conveyancers need to be honest and upfront about why their criteria have changed. Even if a ground rent is rising broadly in line with inflation (and remember in most cases it lags significantly behind either due to the saw toothed nature of the rent review pattern or because the review terms are fixed at below inflationary rates) it cannot possibly be a problem for a mortgage lender, as the rent is simply the same as it was at the start in real terms. Blaming the lease and the ground rent is misinforming sellers, holding up transactions and raising unnecessary bills for lease variations.